Even if you don’t want to visit a branch, mobile banking has become a popular option to access banking services at any time. Lloyds Bank has been around for over 200 years, but it has only recently begun to recognize the significance of this development.

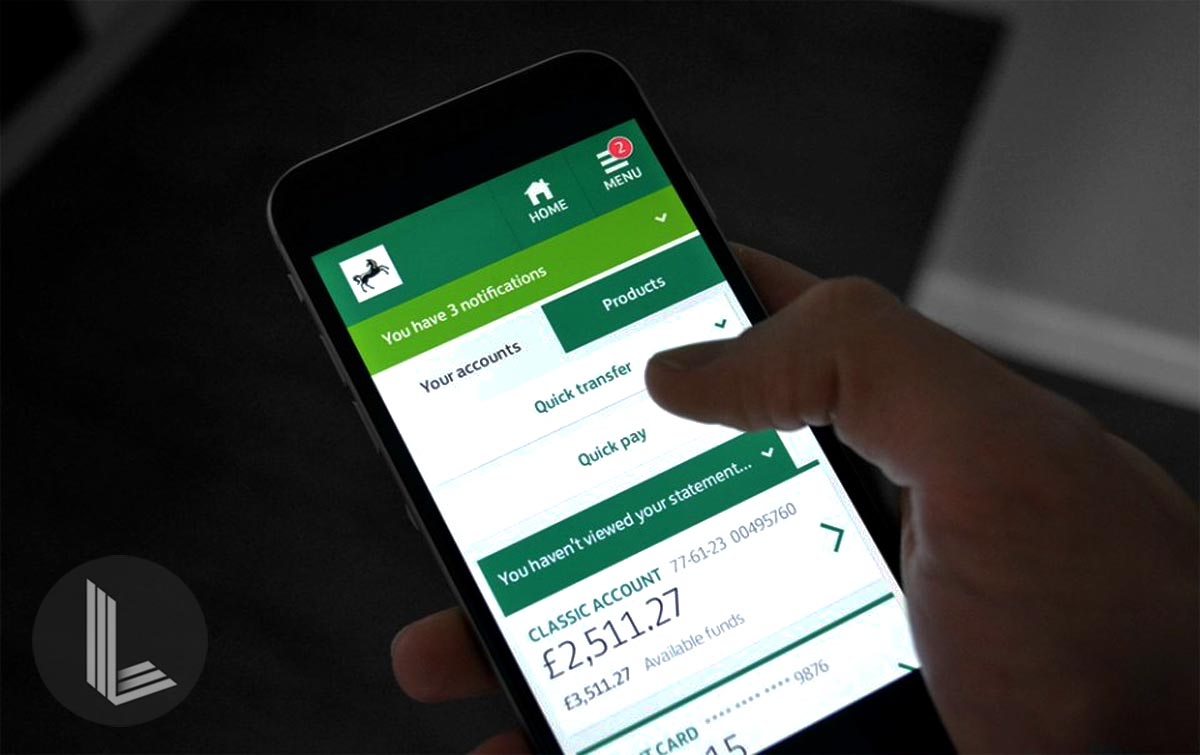

The bank released an app called Lloyds Bank Mobile Banking, which provides access to practically all of their personal banking services. Customers can undertake a wide variety of banking activities, including transferring funds, depositing checks at any branch, placing holds, seeing PINs, and more.

See below for a description of the benefits of using the Lloyds Bank Mobile Banking app. Learn more about the app’s credit card application process.

The Services Offered By Lloyds Bank

The goal of Lloyds Bank as a bank is to offer its clients banking and financial services. Because Lloyds Bank is dedicated to assisting those in need of financial aid, it is renowned for offering excellent financial support.

Credit cards, loans, auto insurance, savings, investments, pensions, house insurance, auto insurance, van insurance, life insurance, and mortgages are just a few of the many services that Lloyds Bank provides to its clients.

Through its website, online banking, and mobile banking app, you may now access all of these banking services. These services are accessible to all Lloyds Bank clients.

What Is Lloyds Bank Mobile Banking App?

Lloyds Bank introduced its mobile banking services to satisfy client demand for user-friendly banking services. In 2016, we released the app in both the Google Play Store and the Apple App Store.

Downloading the banking app won’t cost you a dime. A Lloyds Bank account is required for use. After registering, customers have easy access to Lloyds Bank’s services.

Customers of Lloyds Bank must have the most up-to-date versions of iOS or Android installed on their devices in order to enjoy a seamless mobile banking experience. To use the app and make use of its functions, you’ll need a reliable Wi-Fi, 3G, or 4G internet connection.

For added security, users should also have an account with the Apple App Store or Google Play. Last but not least, you should make sure that your phone number is current with the bank, as you will need it to register for the mobile banking app.

How to Create an Account on the Lloyds Bank Mobile Banking App?

Signing up for an app account with Lloyds Bank required a number of steps. Before opening an account with Lloyds Bank, consumers are required to provide basic personal information such as their name, date of birth, postal code, and account numbers. Then, every single user must generate their own unique ID and passcode.

In addition, the app recommends that first-time users read the Legal information. To make sure the registered phone number is secure, Lloyds Bank Mobile Banking will also call or text it. This authentication process ensures that they are legitimate Lloyds Bank clients.

A four-digit verification code will be displayed on the screen. Users have the option to either enter the code and wait for a confirmation from Lloyds Bank Mobile Banking confirming their registration was successful.

What Is the Alerts Feature of the Lloyds Bank Mobile Banking App?

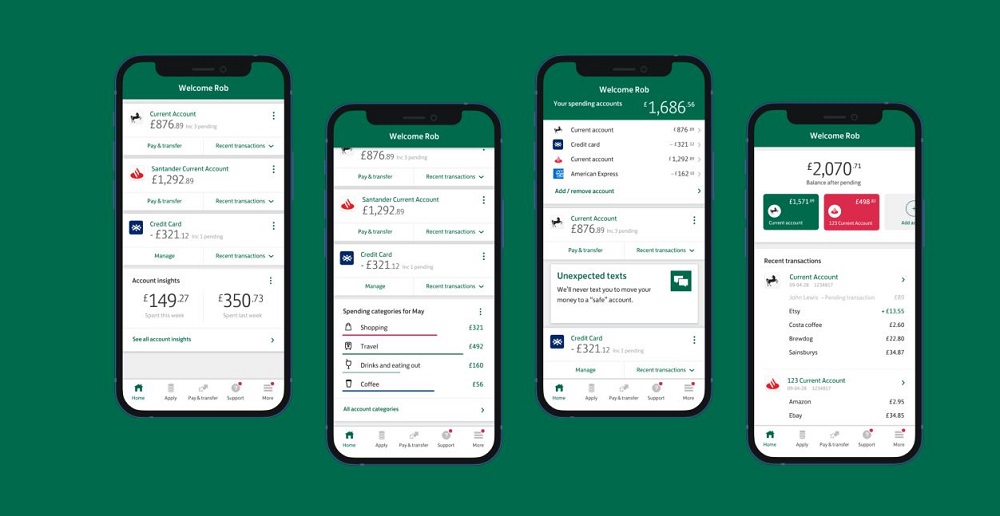

In addition to being easy, Lloyds Bank Mobile Banking also aids customers in keeping track of their activities, transactions, and other crucial deadlines. Users of the app will receive numerous alerts.

- Smart Alerts

Users should be notified when their transactions have been completed successfully. Customers can monitor their finances using Smart Alerts and receive notifications whenever there is a transaction involving their funds. In addition, the users will be reminded of the frequency of their payments. - Purchase Alerts

When a user makes a purchase using their debit card, a notification is provided through Lloyd Bank Mobile Banking. Upon completion of the transaction, the message will be sent immediately. The notifications will attest to the success of the transaction and follow its progression.

The Spending Summary feature of the Lloyd Bank app provides a weekly summary of the purchases made instead of requiring manual tracking of debit card purchases via Purchase Alerts.

How Can You Set the Notifications on the App?

The notifications function of Lloyds Bank Mobile Banking must be understood by users, along with instructions on how to set it up. Users are responsible for determining which notifications will be displayed.

The Profile & Settings cog in the upper right corner of the app’s main screen is where you may activate the push notification on your mobile device. Find Notifications by navigating to the Settings menu. There, consumers can flip the switches to activate the notifications that are most important to them.

How Can You Deposit Cheques Through the App?

The Lloyds Bank Mobile Banking app has the ability to deposit checks as one of its cutting-edge features and services. You can deposit checks using the mobile app, according to the bank, thanks to this capability.

This service, according to Lloyds Bank, is simple, fast, and convenient. Users can take a picture of the check using the mobile banking app. You can just enter the relevant information into Lloyds Bank’s Mobile Banking app, and it will process it immediately.

The convenience of being able to utilize the service whenever and wherever suits you best makes it a time- and effort-saving option. To deposit and process checks, customers do not need to visit Lloyds Bank offices. The money will be accessible through the app the following business day, according to Lloyds Bank.

When a check is deposited through the app, the bank will immediately begin processing it.

How Can You Transfer Money on the Lloyds Bank Mobile App?

Lloyds Bank Mobile Banking is similar to other mobile banking apps in that it allows users to send and receive money from anyone. Only a local mobile number is needed.

If you want to send money quickly, add these numbers as contacts. No bank account information will be required of them. Users must select the recipient and enter the desired amount before sending money.

Can You Freeze Your Card on the Lloyds Bank Mobile Banking App?

Lloyds Bank wants people to control their debit and credit cards. They allow them to freeze and unfreeze account transactions at any moment using the Lloyds Bank Mobile Banking app.

It’s convenient because people don’t have to contact or visit the bank to report misplaced cards. This feature can restrict card use in addition to missing cards. The app’s home page’s “Manage card” button freezes or unfreezes the card. Tap “Card freezes and limits”.

Users can browse the list of cards and toggle freeze parameters like transaction usage. These modifications are immediate.

How Does Lloyds Bank Follow the Open Banking Policy?

Lloyds Bank ensures that consumers have more control over their data or personal information in accordance with recent modifications to the United Kingdom’s data privacy and access policy. This simplifies internet banking.

People may manage their money in innovative ways thanks to Lloyds Bank’s mobile banking app. Mobile banks can now exchange user data. Even across banks, users can view all their bank accounts.

Banks and other organizations that aren’t banks can offer these new services because to the Open Banking policy. Competition is fiercer. Lloyds Bank pledges to make these new services accessible and useful.

Can You Apply for a Credit Card?

Anyone looking to apply for a credit card at Lloyds Bank is welcome. The bank’s website or mobile banking app is used to complete the application process.

You’ll need to provide some background data, such as your bank details, annual income, and other financial obligations.

You should check your eligibility before submitting an application. Make sure you’re qualified by visiting the bank’s website. What credit cards you qualify for and how much of one you can request will be displayed here.

How Can You View Your PIN Through the Mobile Banking App?

Customers who carry multiple cards are more likely to forget their PIN. This problem can be solved by Lloyds Bank. They now have access to their PIN via the app.

When a consumer registers for Lloyds Bank Mobile Banking, their personal identification number (PIN) is securely stored in the app. Users must be the primary account holders on any credit cards used.

Conclusion

With the help of the Lloyds Bank Mobile Banking app, clients may access the bank’s banking services from anywhere and at any time.

Customers can access the Open Banking services, receive notifications, deposit checks from anywhere, transfer money, receive free cards, and view their PINs all via the app.