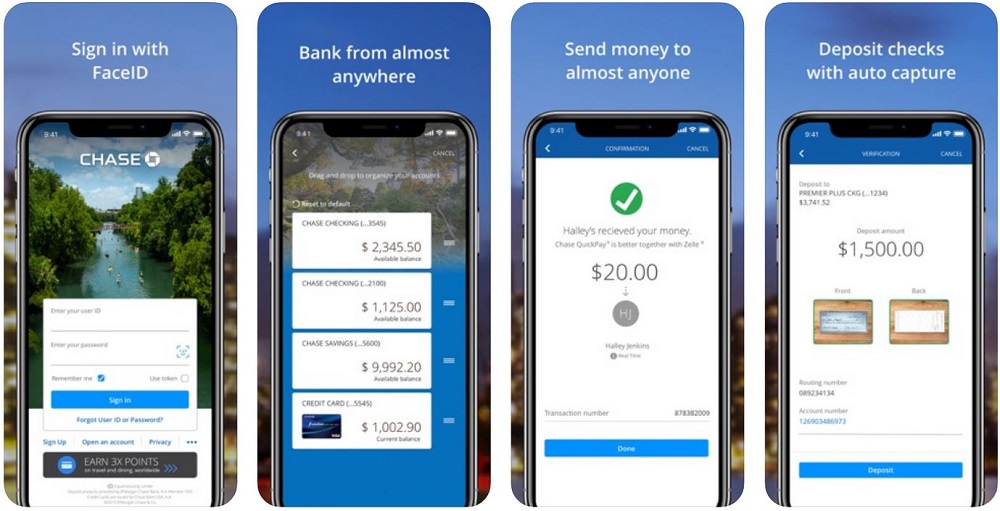

In order to offer us mobile banking services, Chase Bank has developed the Chase Mobile app. We can manage all of our Chase accounts and activity in one location thanks to the application, which is available for both Android and Apple mobile devices.

The ability to check my credit score and spending, transfer money between accounts fast, receive deposit checks, and redeem rewards are just a few of the general banking services that I find to be quite beneficial while using the mobile banking application.

Among the several apps I use, my favorite is the Chase banking app. It offers me access to a wide variety of useful services that make my life simpler. This feature includes a personal finance section as well as mobile check deposits, transfers, and eDeposit. These conveniences, along with others, have greatly improved my time spent banking.

Over 10 million people have downloaded the Chase mobile application from official retailers. It has 1.7 million Google Play Store reviews and 4.4 million Apple Store reviews from these downloads. The mobile application has a 4.4 Google Play rating and a 4.8 Apple rating. It’s no surprise that the Chase Mobile app is a practical method to monitor account balances, pay bills, send money, examine and change eligible transactions, and receive account alerts.

Chase Mobile is an easy-to-use application that lets you bank anytime, anywhere. Chase Mobile offers quick transaction processing and centralizes all of my banking activity information with a straightforward and user-friendly interface.

The Chase Bank mobile app, ranked fourth in finance on the Apple Store, is free and offers a comprehensive banking experience. Its clean functionality, fast setup, and accessibility make up for its shortcomings compared to competing banking apps.

Manage All Types of Accounts

Whether you use Chase for your personal banking, business banking, or both, the Chase app makes it easy to keep tabs on all of your accounts from a mobile device. You may manage your core banking transactions with the Chase Mobile app by using your smartphone or tablet to deposit checks or wire money, pay bills, and request cashier checks.

Furthermore, I am able to handle all of my personal, family, vehicle, and business banking accounts from the convenience of my mobile application. This is a huge assistance in organizing my banking activities for the better. For instance, via a single site, I can quickly check my Chase bank accounts, keep tabs on the progress of my auto loans, and keep close tabs on my mortgages.

For me, the Chase Mobile app is still in its infancy, but already its conveniences, like QuickDeposit, which allows me to scan checks and deposit items without visiting the bank, have won me over.

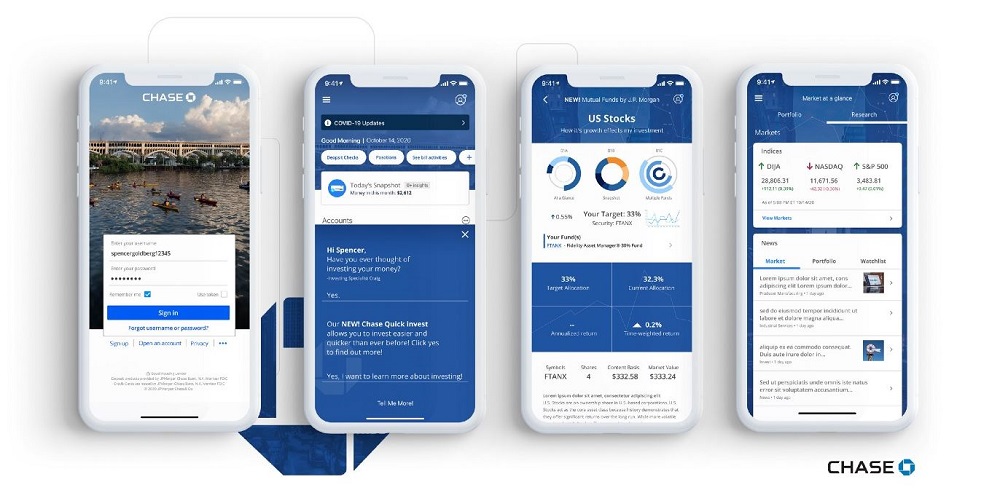

Manage Investments

The Chase app includes everything you need to get started or continue your investment journey with JPMorgan. First off, you can make commission-free investments in stock options, exchange-traded funds, and mutual funds without having to pay any additional fees. Money market funds and other equity asset options are also available for investment.

Despite the fact that I don’t have any investments with JPMorgan, I did find their portfolio views to be very user-friendly. What’s more, my research has led me to believe that each portfolio view may be tailored to your own investments and objectives; this means that the app can also function as a potent personalized investment tool.

Payment Processing

For my part, remitting and collecting payments has been as painless as could be. The Chase mobile app now contains a “QuickPay” feature made possible through a collaboration with Zelle. As long as your partners are registered with Zelle, I can send and receive payments with Chase bank users and even users of other banks outside of JPMorgan’s network.

Wire transfers may be sent instantly from the app, and there are no transaction fees for any of my banking transactions using Zelle.

Users’ payment management is also given a lot of focus in the Chase mobile banking app. For my credit card bills and other commitments, I have used it to schedule payments, change payments simply, request payments from other Zelle users, and cancel payments.

Best App for QuickPay Features

Businesses who accept cash and checks will find the payment platform particularly useful. These include firms in the beauty and health sector, as well as those in the rental and transportation sectors. Both Chase and Zelle concur with this assessment.

Know that you are receiving the best payment processing service if your business falls into any of these categories. You may easily maintain business cash flow distinct from personal accounts and specify how you wish to collect payment from clients and make payments to suppliers.

Payments initiated with QuickPay on the Chase mobile app are typically handled within minutes, while the availability of some of my larger payments has been known to extend to three business days after initiating the process.

However, in order for payments to be handled using QuickPay without any issues, both parties must have a checking account in the United States.

Credit and Budget Management

The Chase mobile application also has capabilities for keeping tabs on our credit score, credit card activity, and budget. Through the Credit Journey tool and the Budget Planner feature, these are accessible.

Through the application, I signed up for the Chase Credit Journey program. My current credit score and credit transactions are sent to me without charge. This method of keeping tabs on my transactions has made it much easier for me to spot illegal charges on my credit card.

With the help of the Budget Planner tool, I can restrict the amount of money I spend on debit and credit transactions, keep track of them, and get detailed reports on my day-to-day finances. I can get a breakdown of my monthly spending on things like groceries, gas, and clothes by clicking on the “Today’s Snapshot” button, which also includes statistics on how much money I make.

Monitor Chase Offers and Rewards

As a Chase credit card holder myself, I can attest to the convenience of having a single location to view the status of all of your Chase offers and the sum total of any money you’ve earned through them. Cash-back incentives, discounts, points, and any other perks you receive for using a specific credit card qualify as offers.

The Chase mobile app makes it easy for me to keep track of my rewards, redeem them at participating stores, and earn statement credits for completing Chase offers.

Getting Started With the Chase Mobile App

If the application appeals to you, installing it on your smartphone is a simple process. But first, there are certain details to consider.

Users of Apple iPhones and iPads must have a device with iOS 13.1 or iPadOS 3.2 or later and 360 MB of available storage space. You can easily download the Chase app by going to the Chase section of the Apple Store on your mobile device and tapping the “Get” button.

Android users, like me, require a device with Android 8.0 or later and at least 81MB of free space. If your mobile device meets these requirements, you can download the Chase app from the Google Play Store.

You can also send the word “mobile” to the number 24273 to receive an official download link from Chase Bank. It’s important to remember that downloading banking apps from any other source than their official stores or web platforms could put your personal information at risk.

Your Chase Business online login and password are used to log in once the application has been downloaded and installed on your mobile device. If you don’t already have one, you can make a Chase Business online profile.

After requesting and specifying a method of delivery for an ID code, you’ll use that code and a password to access the secure area of the site. You can now join me in taking use of all the benefits the Chase mobile banking app has to offer.